SW Florida Real Estate Foreclosures – Update

During the period after the real estate crash foreclosure sales were extremely high and the result was that many programs such as “Trump University”, Robert Kiyosaki’s “Rich Dad Coaching”, Than Merrill’s “Flip this House” or and many others promoted how easy it is to make money flipping and rehabbing houses. The result was that many serious and also “wannabe” investors flooded the market and buying foreclosure homes for pennies on the dollar. The reality is that it is now 9 years later and these programs still claim to show how easy it is to make money flipping houses. We get daily requests from students of these programs to find them foreclosure homes to flip. The reality is that these homes are very few and far between.

A lot is written about Florida real estate foreclosures and this prompted some research on this topic. The result of this research was astounding:

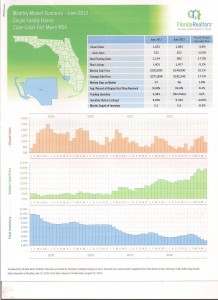

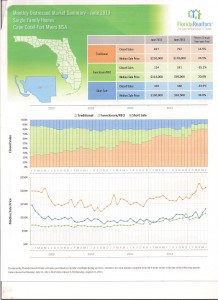

- In both the Fort Myers real estate and Cape Coral Real estate markets a total of 848 real estate foreclosure homes sold during the period 1 January 2015 to 31 May 2015 – Average sales price was $155,000.

- During the same period in 2016 only 383 foreclosure homes was sold, representing a reduction percentage of 121.4% homes sold for the same period – Average sales price was $168,000

- Looking back in history to 2009, a total of 2933 real estate foreclosure homes sold in the period 1 January 2011 and 31 May 2011 at an average price of $93,000.

Doing the math shows that real estate foreclosure home sales decreased by 665.7% in the past 7 years.

Today (20 June 2016) for the areas of Ft Myers and Cape Coral, a Grand TOTAL of 76 foreclosure homes are listed on the MLS, with prices ranging between $49,900 and $999,000, with only 22 of those available at below $150,000.

Still these programs go around the country promising to show potential investors how “easy” it is to make money flipping houses. There are 2547 fewer foreclosure homes available now in 2016 than was available in 2009, and 465 fewer foreclosure homes than was available in 2015 (One Year Ago)

These statistics may provide more clarity on what potential investors will experience as far as availability and price ins concerned when when they enter either the Cape Coral real estate market or the Fort Myers real estate market.

Gone are the days where homes were sold for pennies on the dollar, but having said that, buying foreclosure homes may still represent good value for money, just make sure you do proper due diligence. Your real estate agent will be a valuable asset in this research.

If you want more information on foreclosure homes or want to look at the list of available SW Florida foreclosure homes for sale just visit : http://greaterswfl.com/distress-sales

Lee van Der Heyde

(240) 439-5256

teamfloridalifestyle@gmail.com

#foreclosures

#foreclosurehomes